Buying and selling stocks using mobile devices has become a daily activity in today’s world. Some of the best stock trading apps even offer stocks and ETFs with zero commissions. These apps are simple to use and provide a fully-featured online trading experience whether you are a beginner or seasoned active trader.

If you want to start investing in stocks, we have listed some of the leading apps to buy stocks for free. These apps are great for technical analysis, understanding stock structure, finding and scanning for trading stocks, and, most importantly, backtesting your trading strategies.

Outstanding Apps to Buy Stocks for Free

Buying stocks is now made hassle-free thanks to the rise in popularity of stock trading apps which you can access on your smartphone. These platforms also solve a lot of problems that most new traders encounter, including high commission fees.

The following are some of the top-notch apps to buy stocks for free and with minimal starting cost.

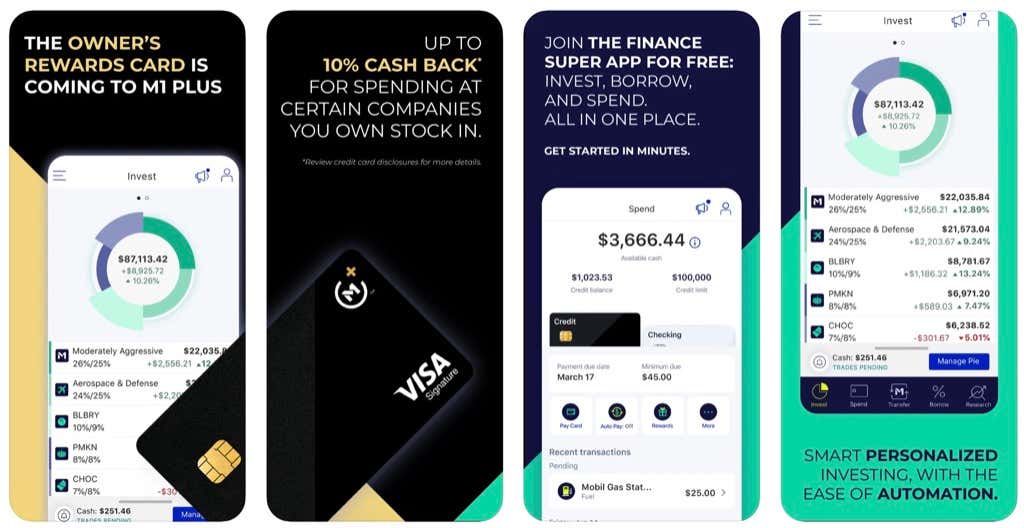

1. M1 Finance

- Minimum Investment: $100

- Commission: $0

- Monthly Fee: $0

- Account Type: Taxable, IRA

- Best for: Beginners

M1 Finance is perfect for passive investors and those who are just getting started in the investing world. The platform merges the best off low-cost brokerages and behavioral alpha that can boost their confidence in investing.

The platform also facilitates sound investment strategies such as low-cost exchange-traded funds (ETFs) and individual shares. M1 Finance also has several tools to help you set up your ideal portfolio and even automate contributions.

M1 Finance also utilizes Assets Under Management (AUM)- a free Robo advisor service for its standard accounts. This free access feature allows M1 Fiance to compete with some of the cheapest players in the space, including SoFi Invest and Charles Schwab’s Intelligent Portfolios.

Furthermore, the app also offers free advisory and allows investors to add fractional shares to their portfolios. Aside from automating investments, M1 Finance also provides automatic rebalancing to ensure you are buying low and selling high.

Other notable features include Smart Transfers for premium members, making it easier to switch funds between their Spend and Invest accounts. The platform also recently added a line of credit to their users through a feature called M1 Borrow.

Pros

- Plenty of bonus offers

- Constantly adds more features and support

- Allows custodial accounts

Cons

- Not designed for active traders

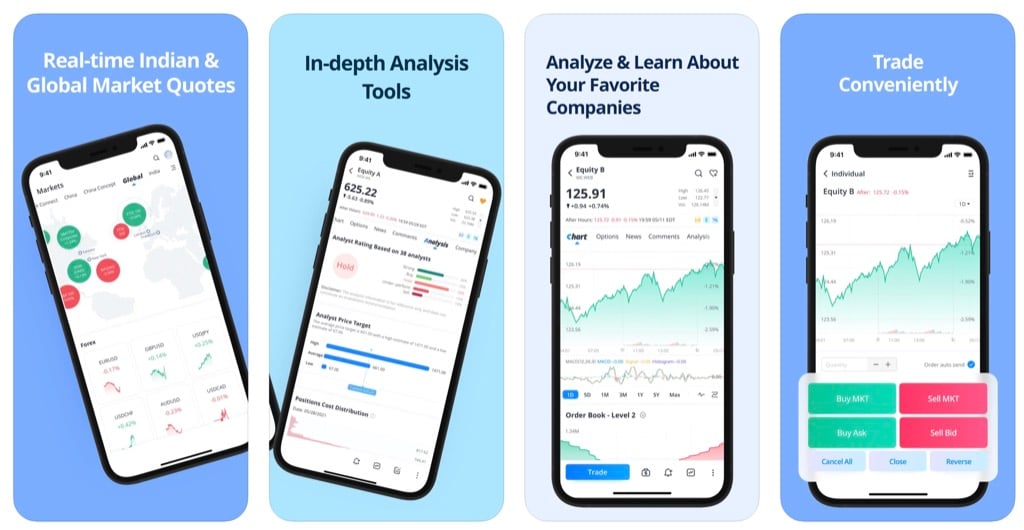

2. Webull

- Minimum Investment: $0

- Commission: $0

- Monthly Fee: $2 per month (Level 2 Subscription)

- Account Type: Taxable, Rollover IRA, Traditional, and Roth

- Best for: Experienced Traders

Webull is an electronic trading platform that doesn’t charge its clients whenever they buy or sell stocks. The app is free to use and has no commissions or trade costs. You may also trade and invest in thousands of individual stocks and ETFs using the app.

Unlike most of its competitors, Webull provides additional tools that make account management more effortless. The platform includes significant built-in research, data, analysis, and charts to assist you in making more informed stock trading decisions.

Webull is great for technical traders thanks to its 20 charting tools and over 50 technical indicators. Moreover, reversing your position requires a few taps on your smartphone. The platform also has extended trading hours wherein you can trade in pre-market sessions.

It also has a paper trading tool that allows you to trade with virtual money. Hence, you can practice trading using Webull’s virtual stock trading account without risking your actual money.

Webull is also worth considering because they provide complex order kinds. Market orders, limit orders, stop-loss orders, and stop-limit orders are all available to you. Unfortunately, they only accept account applications from U.S. residents.

Pros

- Free stocks, options, and ETFs

- Low trading fees

- Opening an account takes about a day

Cons

- It doesn’t support bonds, mutual funds, and pink sheet stocks

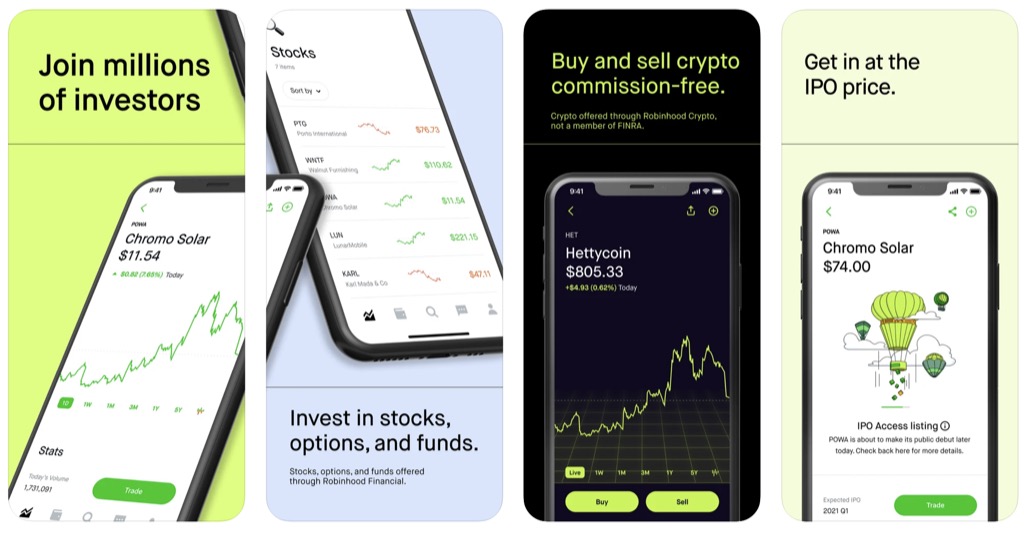

3. Robinhood

- Minimum Investment: $0

- Commission: $0 for stocks, crypto, ETFSs options

- Monthly Fee: $0

- Account Type: Taxable

- Best for: New Investors

Robinhood’s popularity as a commission-free stock trading platform only increased during the recent GameStop short squeeze. However, even with all the controversy, the app is still a solid choice for beginner investors.

Its app is user-friendly and straightforward to use. Robinhood also allows you to trade and invest in hundreds of individual stocks and ETFs on its platform. There is no minimum amount required to open an account.

Furthermore, as part of automating your trades, the platform provides sophisticated order types such as market order, limit order, stop-loss order, and stop-limit order. By placing orders in advance, you can purchase or sell your stocks at the prices you want.

Thanks to its integration with Robinhood Crypto, you can also trade cryptocurrencies without leaving the platform. You can use this service to buy, sell, and exchange popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, etc.

However, since the federal interest rate rises over time, Robinhood’s interest rate can also fluctuate. Unlike its competitors, Robinhood is less limiting to the people who can use the platform as they allow non-U.S. residents to use the app as long as they have a U.S. visa.

Pros

- Allows dividend reinvestment and fractional shares

- Facilitates commission-free trades

- Utilizes security features such as Apple Touch for logging in

Cons

- The platform has become a bit unreliable since the GameStop issue

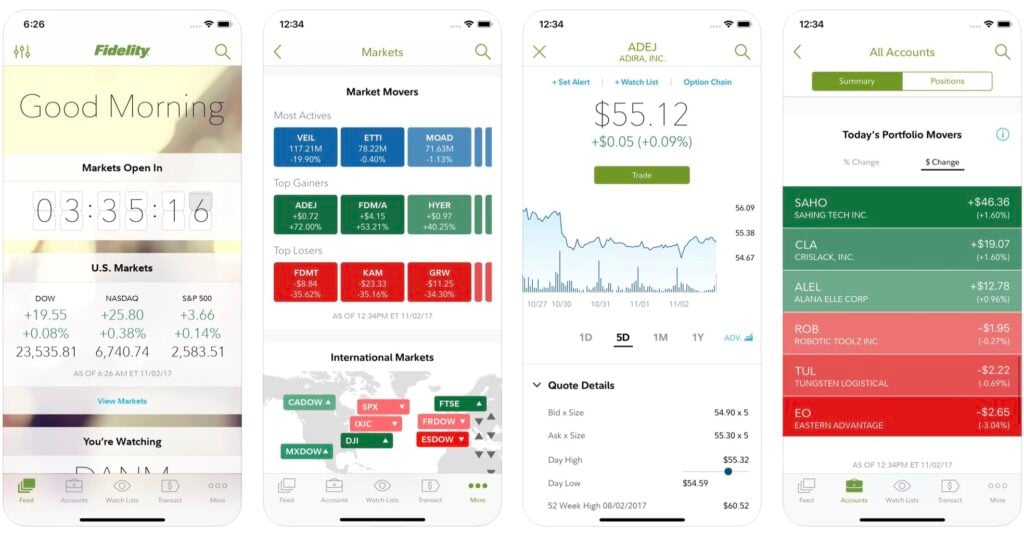

4. Fidelity

- Minimum Investment: $100

- Commission: $0 for stocks, ETFs, options

- Monthly Fee: $0

- Account Type: Taxable, Trust, IRA, 401K, HSA

- Best for: New Investors

This industry-leading online broker has one of the largest customer bases. Both Fidelity’s website and the app offer tools to help everyday investors keep track and manage their portfolios.

Moreover, Fidelity is one of the few players that does not accept Payment for Order of Flow (PFOF) which saves you money when placing stock trades.

Fidelity is widely regarded for its stellar research. Their stock, mutual funds, and ETF screeners are rich in data and are easy to use. The company utilizes the largest number of third-party research reports for both ETFs and stocks.

Another great boon about Fidelity is that it doesn’t have any hidden fees or account service fees. However, there is a flat fee of $19.95 if you opt for broker-assisted trades. Meanwhile, Fidelity also has zero expense-ratio mutual funds, which can further help you save on costs.

The Fidelity app boasts a gorgeously designed and customizable dashboard. Its market cards cover everything from watch list insights to market news. Moreover, the app also has note-taking functionality, which allows you to save your thoughts on individual stocks.

However, one of the main drawbacks of Fidelity is its subpar active trader functionality. It has very few indicators available, with as few as two on Android devices. In comparison, the industry average is more than 30 indicators. Hence, it’s not well suited for active traders.

5. Public

- Minimum Investment: $5

- Commission: $0

- Monthly Fee: $0

- Account Type: Taxable

- Best for: Small-time Investors

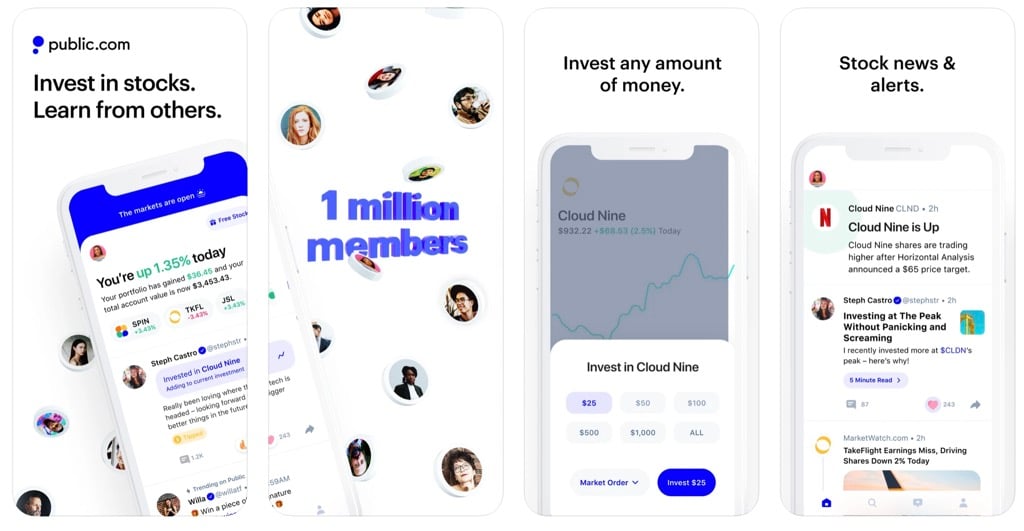

Public is a stock trading and investing platform that charges no commissions. There are no monthly account maintenance or membership fees nor minimum account balance restrictions in the app.

Contrary to most people’s first impression, Public isn’t exactly a new player in the industry. It’s a rebrand of Matador, one of the pioneering app-based investing products in the country.

Public also has a beautifully designed and user-friendly smartphone app that you can download on Android and iOS. With just $5, you may begin trading on the app. You can invest in and trade thousands of individual equities in ETFs if you go public.

You can also invest in and trade fractional shares of equities, known as slices, through the app. Instead of buying the entire stock, you can purchase a fraction of it. Public also features a unique social layer, which includes a social community to chat with your pals. You can also reach out to industry leaders and specialists in the field of investing.

Another unique aspect of Public is that you can earn a substantial interest on your cash balance. Uninvested cash in your cash balance that isn’t invested in your Public portfolio can make you a modest percentage. However, they don’t allow day trading, plus only U.S. residents are permitted to join the platform—at least for now.

Pros

- The app has social investing features

- Allows fractional shares for as little as $1

- Low barrier of entry

Cons

- Limited investment options compared to its competition

Welcome to the New Investing World

There are tons of other apps to buy stocks for free, which you can download on the Google Playstore or Apple store. However, the ones on the list are the most reputable, showing incredible results.

When choosing the best apps to buy stocks, it’s essential to consider their advantages and disadvantages. Furthermore, you should also take into account if they offer additional services such as access to cryptocurrency.