If you’re an avid online shopper, you may have noticed or even used a service called Afterpay. This is a company that partners with online retailers to give their customers the option to pay for their product in increments over a certain period of time.

Afterpay isn’t actually the only service like this out there, though. There are quite a few others which offer a similar way to pay for your online buys. These services have some different features than Afterpay does, so if you enjoy using that but are wondering what else is out there, it’d be worth it to look into these other companies.

So here are the best Afterpay alternatives to use while you shop.

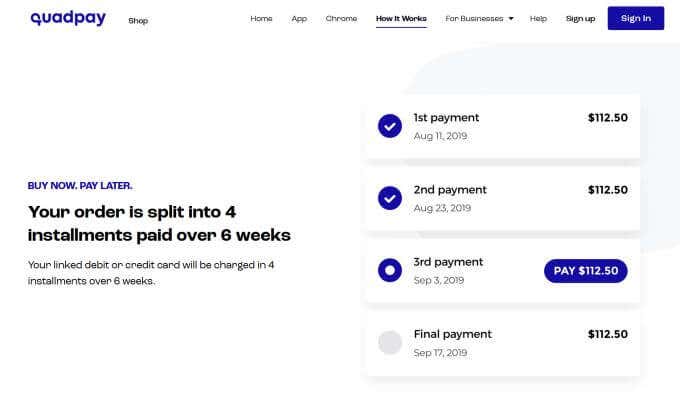

1. Quadpay

This pay later service is very useful as you can use it with any store that accepts Visa, not just specific partners with the company. This means you can do four payment installments on nearly any purchase online.

This service works by essentially giving you your own card through Quadpay, which you can then use to pay for your purchases. Then, through the app, you can pay it back over a six-week period. You can also use this card for in-store purchases by using it with your Apple or Google wallet.

This payment method is also interest-free, meaning you won’t have any added charges for using the service, you simply just pay for what you bought.

2. Affirm

If you need a more flexible payment schedule, Affirm allows you to choose in what time span you pay for your purchases. You can choose to use Affirm at checkout with the retail partners using the service. This includes stores like Walmart, Target, Adidas, and more.

Affirm is a bit different than other Afterpay alternatives, as it does charge interest, though it is simple interest as opposed to compound interest. So you’ll know exactly how much you’ll need to pay up front, and that amount won’t change over time.

You also won’t get charged any late fees or penalties if you forget to make payments. Especially for larger purchases, Affirm is a good choice.

3. Sezzle

Sezzle is very similar to the other pay later services in that it splits up payments into four increments over six weeks. It’s also interest-free, and you can get up to three rescheduled payments per order to maximize flexibility with your payments.

However, Sezzle does charge fees in certain situations if you don’t complete a payment on time, or on your second or third rescheduled payment. It’s a good service to use, however, to shop with small and large businesses as well as businesses that may not already be partnered with Afterpay.

4. Klarna

Klarna is used with lots of large online retailers, such as Amazon, H&M, and Adidas, among others. You can use the Klarna app as well to easily search through every store available to buy from. This service works the same as many of the others, as you pay in four interest-free increments over time.

With Klarna, you pay every two weeks, for a total of eight weeks if you make each payment on time. You also only need to start paying 30 days after you receive the product, so you can decide whether you want to return what you bought. Klarna also has a financing service you can use for larger payments, and pay back within 6-36 months.

Klarna is a great alternative to Afterpay in that it has many of the same features, and is used with many large businesses so that you can use the service almost anywhere. It also has a feature similar to Quadpay that allows you to use the service in-store by giving you a one-time card in your Apple or Google wallet, and then pay for your purchase in four increments afterwards.

5. Splitit

Splitit has many retail partners that you can shop at and then use their service to pay in the same 4-payment increment system used by other pay later services. With Splitit, you use your existing credit or debit card and connect it to the service so that you can then pay by installments. This is also another interest-free option. There are also no late fees with Splitit.

So with Splitit, anywhere that you can use a Visa or Mastercard credit or debit card, you can use this service. That means it will work nearly anywhere. It’s a good option aside from Afterpay if there is a store you want to buy from that others aren’t partnered with already.

Using Buy Now Pay Later Services

These services are great Afterpay alternatives to make purchases you may not otherwise be able to, or to be able to spread out payments over time to fit your budget. Especially since many of them have little to no interest, you don’t need to worry about any accumulating debt.

With all these options, it’s now possible to use the pay later method for virtually anything you want to buy, either online or in-store. Just make sure you follow the correct method for each service and you’ll be enjoying your new purchases in no time.