The first step in your journey to financial independence

Personal Capital is a website and app (Android, Apple) that offers financial management tools and wealth management services. While we’ve never paid for investment advice from Personal Capital, we’ve been using their free tools for several years.

You don’t have to be a fat cat to benefit from Personal Capital’s free tools. In fact, getting a handle on your personal finances is the first step in the journey to financial independence.

You already know we’re big fans of You Need a Budget because it’s a great tool for budgeting the money you already have. However, when it comes to planning for the long-term future, we use Personal Capital.

Tools You Get With Personal Capital

After you’ve created a free Personal Capital account and added all your financial accounts, you’ll see a dashboard displaying a quick overview of your finances.

Additionally, you’ll have access to the Banking, Investment, Planning, and Wealth Management areas of the website.

The Personal Capital Dashboard

Each section of the Personal Capital dashboard contains a quick overview and a link to get more detail.

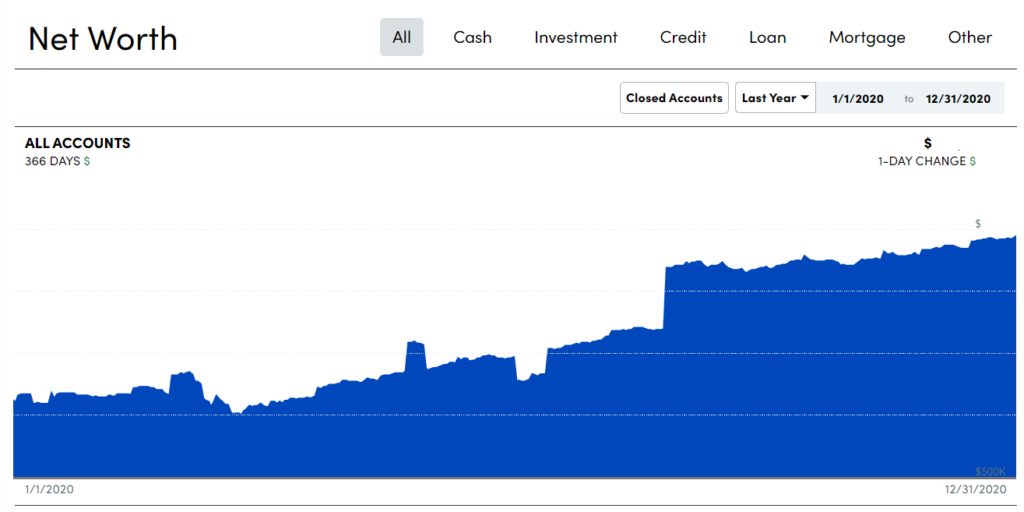

Net Worth

Personal Capital tracks your net worth across all your accounts, assets, and liabilities. Select the Net Worth link on the dashboard to view a more detailed graph. You can specify a time period and include or exclude particular accounts.

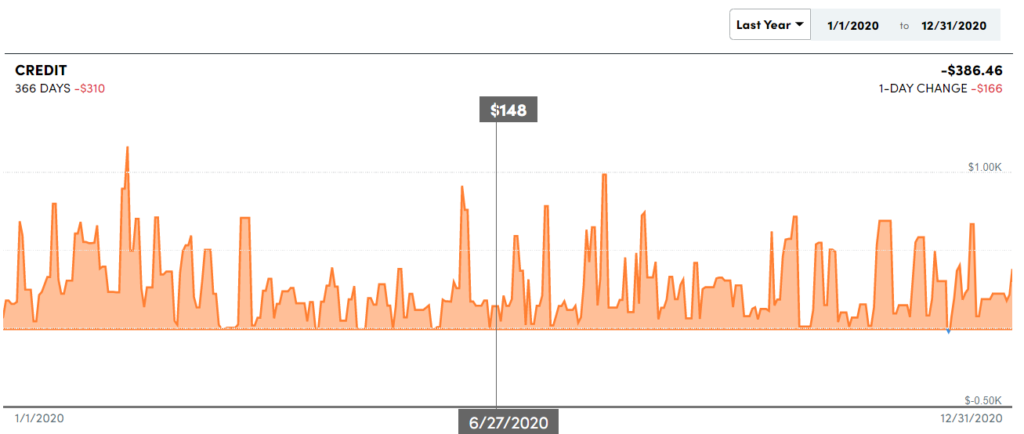

Below the chart, you’ll see a list of transactions included in the net worth calculation. Drill down by selecting a category like Cash, Investment, Credit, Loan, or Mortgage.

Budgeting

Personal Capital’s budgeting tool pales in comparison to YNAB. You can see where your money is going, but you cannot create goals. We recommend ignoring this area and sticking with YNAB for budgeting.

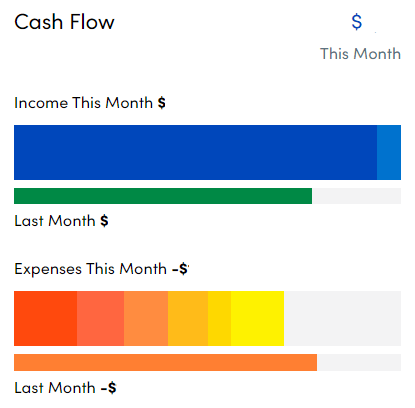

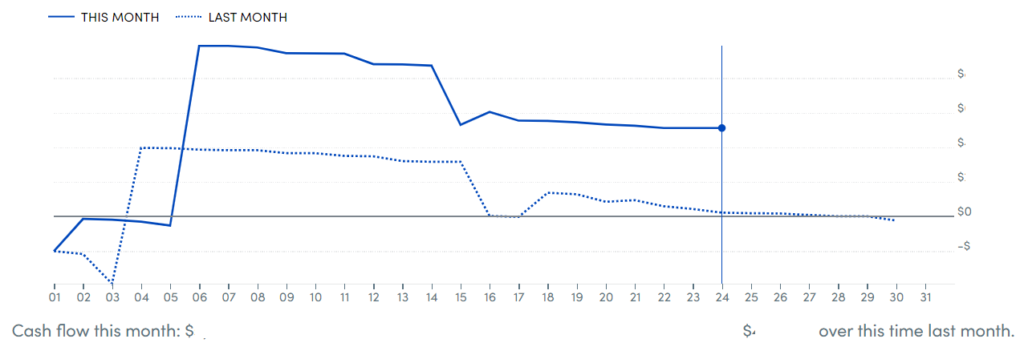

Cash Flow

The dashboard’s Cash Flow widget shows you how much has gone in and come out of your accounts over the past 30 days.

Selecting the Cash Flow link will take you to a more detailed graph. It defaults to including data from all your accounts except:

- Loan or Mortgage accounts

- Transactions categorized as transfers

- Credit card payments

- 401k contributions

- Savings

- Securities trades

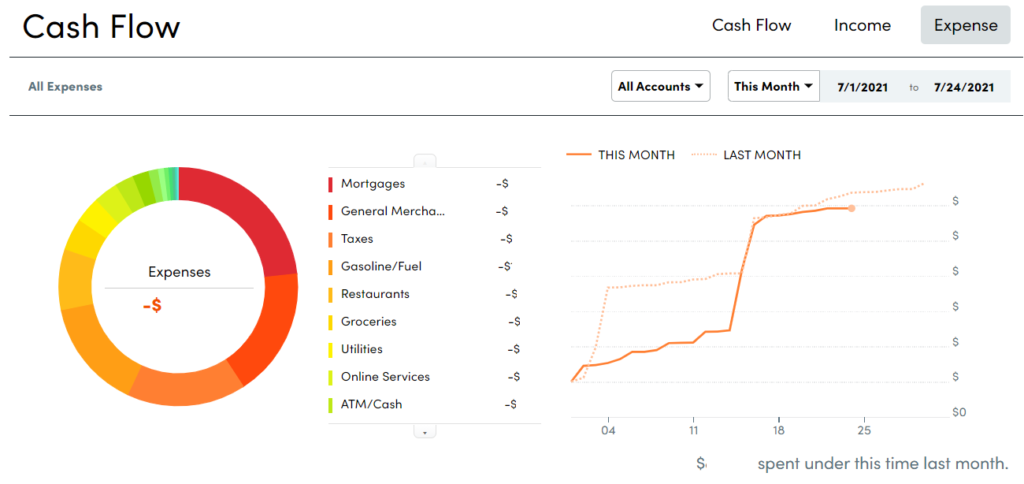

You can also select Income or Expense to view graphs organized by category and time period.

Once again, YNAB offers similar reports, especially if you have the Toolkit for YNAB browser extension. If you do want to use Personal Capital to track this information, you’ll need to classify your transactions so they show up in the right categories.

Portfolio Balance

The Portfolio Balance dashboard widget shows you the balance in your investment accounts over the last 90 days. More on this below.

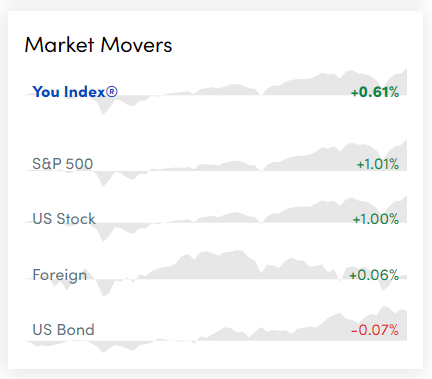

Market Movers

This dashboard widget displays a daily snapshot of your investments (called the “You Index”) vs. the S&P 500, US stock, foreign stock, and US bond markets.

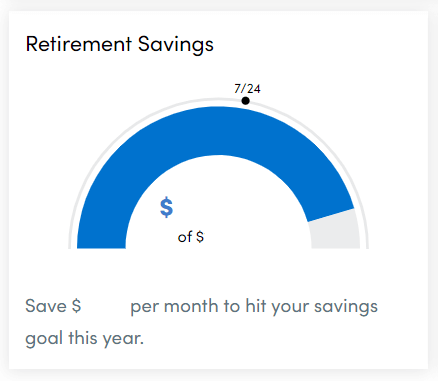

Retirement Savings

The Retirement Savings widget tells you how much you’ll need to save each month for the rest of the calendar year to meet your retirement saving goals.

More on retirement savings below.

Emergency Fund

According to Personal Capital, your emergency fund is the total amount you have in your listed bank accounts, which is not as useful as having a budget category dedicated to your emergency fund. Again, we recommend using YNAB for tracking your emergency fund.

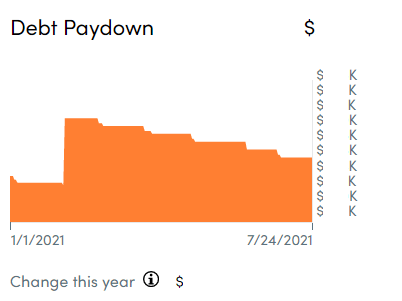

Debt Paydown

The Debt Paydown widget shows progress on paying your loans during the current year.

Select the Debt Paydown link to view a list of transactions included in the graph.

Banking Tools

The Banking menu has links to Cash Flow, Budgeting, Bills, and Open an Account. We’ve described Cash Flow and Budgeting above. The Bills page displays any upcoming bills from your linked accounts.

Open an Account opens a page where you can sign up for Personal Capital Cash, a program that purports to give you higher interest rates than traditional banking products.

Investing Tools

Personal Capital’s investing tools are where it shines.

Holdings

Similar to the Market Movers section, Holdings displays your investments compared to other indices like the S&P 500.

Below the Holding chart, you’ll find a list of your holdings labeled by ticker symbol and info on the number of shares you own, the share price, one-day change, and total value.

Balances

As you would expect, Balances displays the balances of each of your investment accounts over the time period you select.

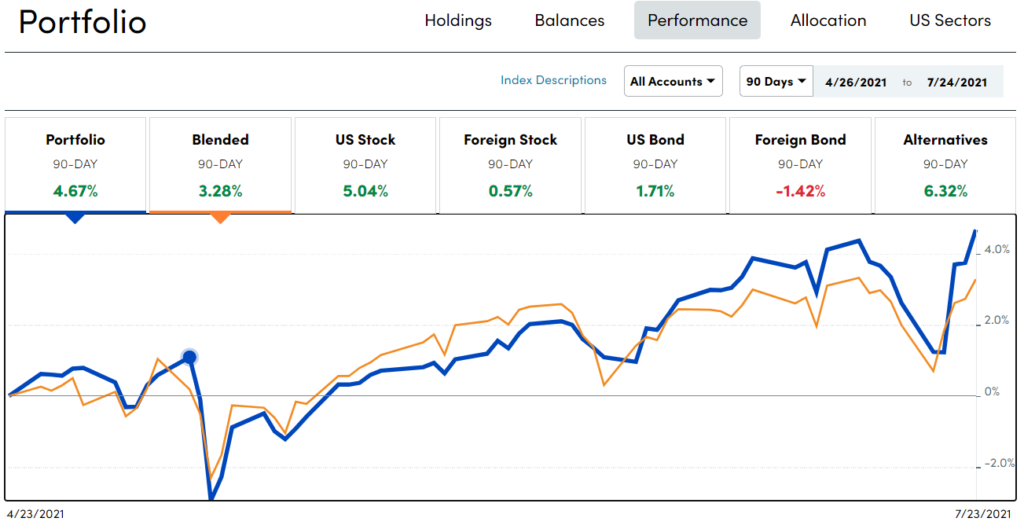

Performance

Performance shows you how each of your accounts is performing in each asset class.

Below the chart is a list of your accounts and information on each account’s cash flow, income, expense, change over time, and balance.

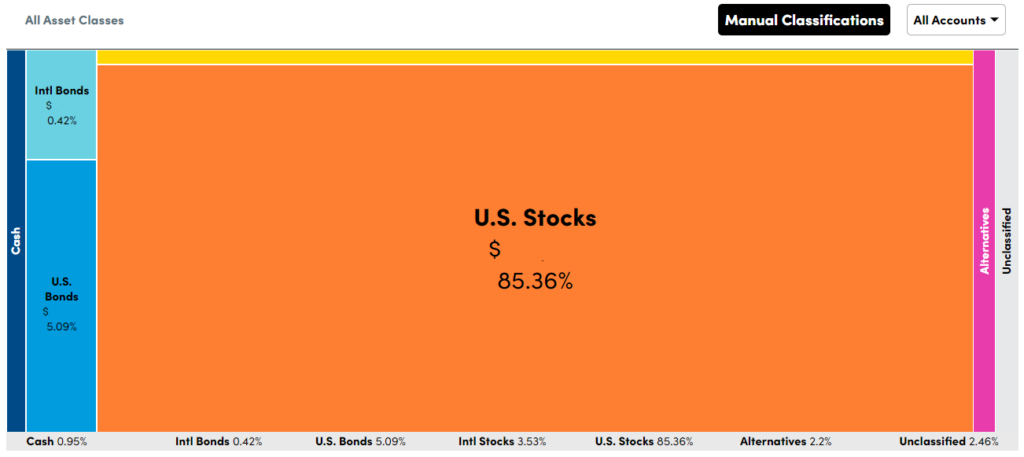

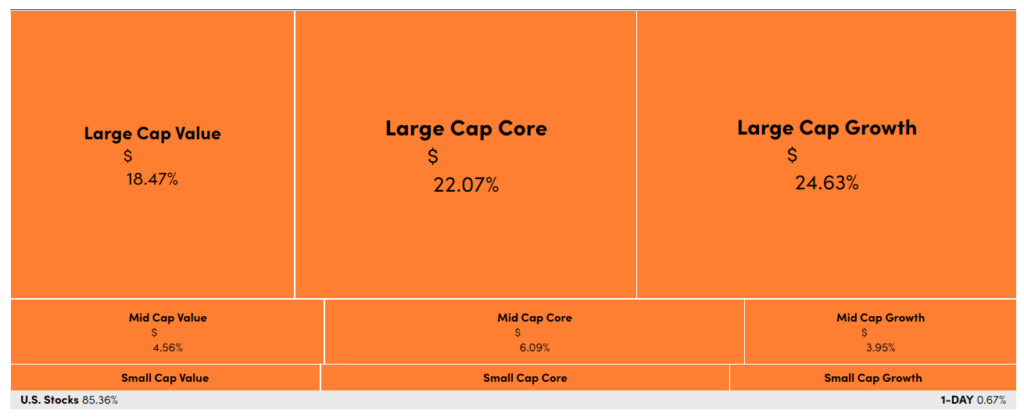

Allocation

Allocation displays how your investments are allocated across asset classes.

You can drill down into each asset class for more info on what kinds of investments you have in that class.

This is particularly useful if you’re invested in index funds and want to see how the fund is invested.

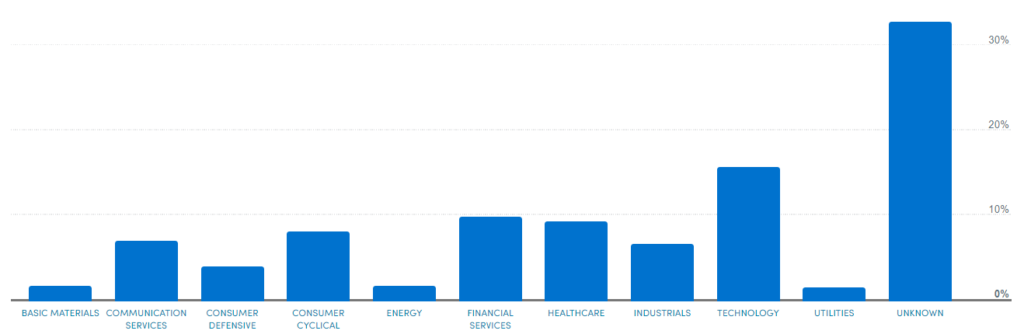

US Sectors

This section displays a bar graph identifying the US sectors you’re invested in, like technology, industrials, and healthcare.

If you have a 401K or another investment account that doesn’t have a stock ticker, you can manually specify which sectors that account is invested in.

Planning Tools

Personal Capital’s planning tools are among its best features—particularly the retirement planner.

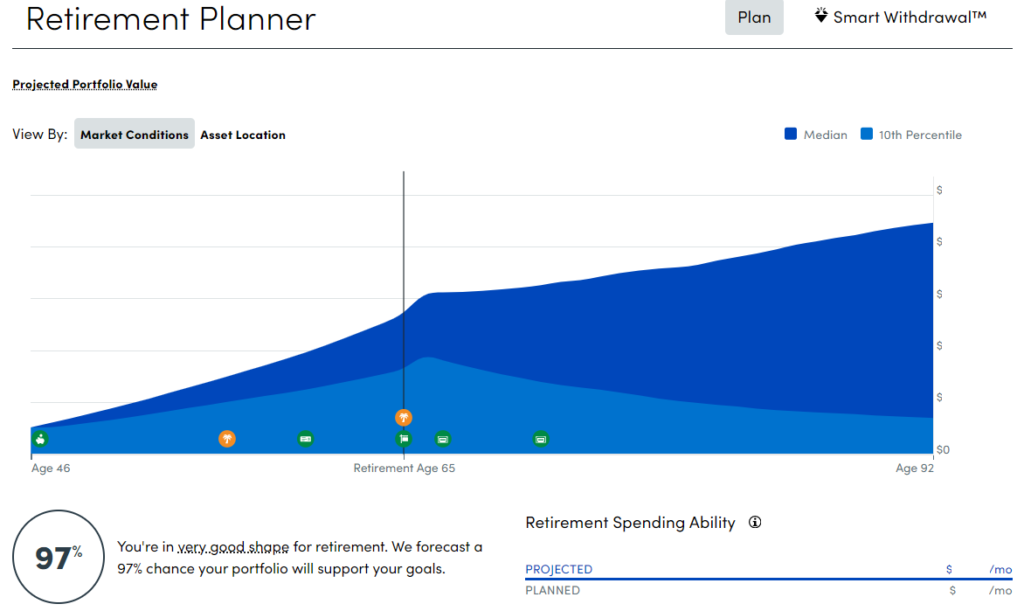

Retirement Planner

First, you tell the Retirement Planner when you want to retire. Then add any income events you anticipate (like a pension, Social Security, or sale of a property) and your spending goals during retirement. It will use a Monte Carlo simulation to predict your chances of success.

You can create multiple scenarios with different assumptions. What if you want to retire early? What effect will having a part-time job for a few years have on your retirement? This tool will help you imagine a variety of futures.

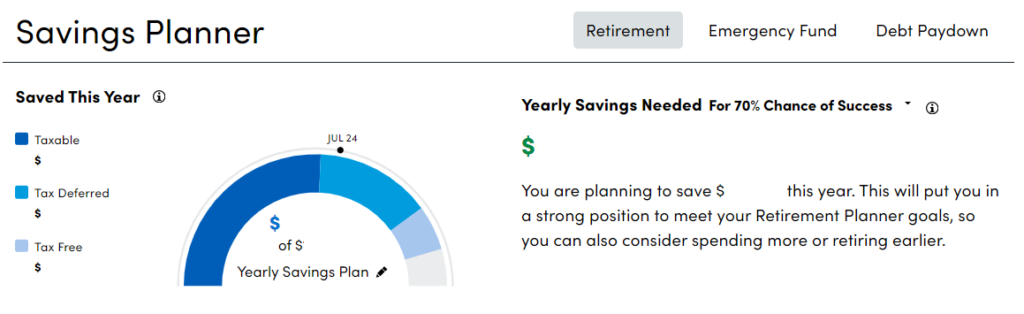

Savings Planner

The Savings Planner tells you if you’re on track to meet your savings goals. It breaks down your savings into taxable, tax-deferred, and tax-free categories.

You’ll also see a list of all your investment accounts and each account’s type, amount saved last year, amount saved this year, and the account’s balance.

Retirement Fee Analyzer

The Retirement Fee Analyzer displays information about the fees associated with your investments to the extent that Personal Capital has access to that information. At the very least, it’s an easy way to view the expense ratio for each of your funds.

Investment Checkup & Wealth Management

Lastly, the Investment Checkup and Wealth Management sections are essentially just advertising for Personal Capital’s financial advisor services. You can schedule a “complimentary” call with an advisor, but watch out—once they’ve identified you as a potential paying customer, Personal Capital will pursue you relentlessly. For most users, it’s wiser to stick to the free tools and manage your money yourself.