We'll show you when and how to use it

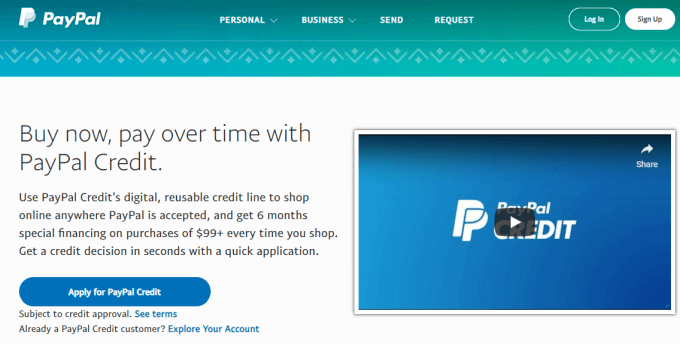

A Paypal credit account is very different than a Paypal credit card. It’s a line of credit that will let you buy things with your Paypal account even if your Paypal balance doesn’t have enough to cover the purchase.

So, why would you want to sign up for a Paypal credit account? There are a few features of this credit line offered by Paypal that has a lot of advantages. Most importantly, it lets you spread out payments over a period of time, without any penalties or interest.

Let’s explore what a Paypal credit account offers, as well as when and why you may want to use it.

What Is a PayPal Credit Account?

Think of a Paypal credit account as a line of credit that gets tacked onto your regular Paypal account.

When you apply for PayPal credit, your credit application gets processed by Synchrony Bank. Since the lowest credit line offered is only $250, a lot of people will qualify for the credit line.

You’ll need to provide your date of birth, net income after taxes, and your social security number. Approval for a PayPal credit account is instant most of the time.

There are a few important things to know before you decide to apply for a PayPal credit account.

- Your credit report will receive a “hard” hit once for the initial credit approval. This could affect your credit report.

- Your initial credit limit will be $250.

- Paying your account on time will likely result in a credit line increase over time.

- The variable annual percentage rate (APR) is 25.99%.

- Sending money to someone (using a cash advance) will cost a fee of 2.9% plus $0.30.

- Not paying off your PayPal credit account on time will not affect your credit score.

- Paying off your PayPal credit account on time will not improve your credit score.

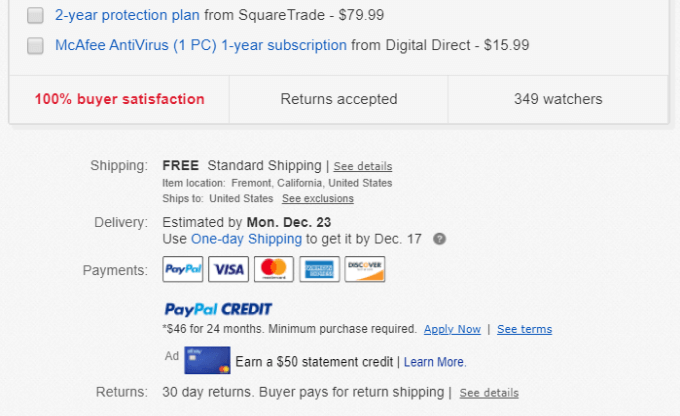

Once approved, the line of credit will get linked to your PayPal account. Whenever you purchase anything anywhere that accepts PayPal, you’ll see your new PayPal credit account as an option for payment.

How To Use Your Paypal Credit Account

Whenever you buy from a merchant that accepts Paypal payments, like eBay, you’ll see PayPal credit listed as a payment option.

Choosing the PayPal credit option processes the payment will process just like you were paying using your regular PayPal account. If you want to use your PayPal credit for all of your purchases, you’ll need to set it up as your preferred payment option in your PayPal account.

There are a couple of things to keep in mind to reduce the amount of fees and interest you end up paying for your purchases.

- Anything you buy over $99, you won’t pay any interest if you pay it off within 6 months.

- Pay at least the minimum monthly payments to avoid interest charges.

When To Use PayPal Credit

There are a few reasons this is better than getting a PayPal credit card (or any other credit card).

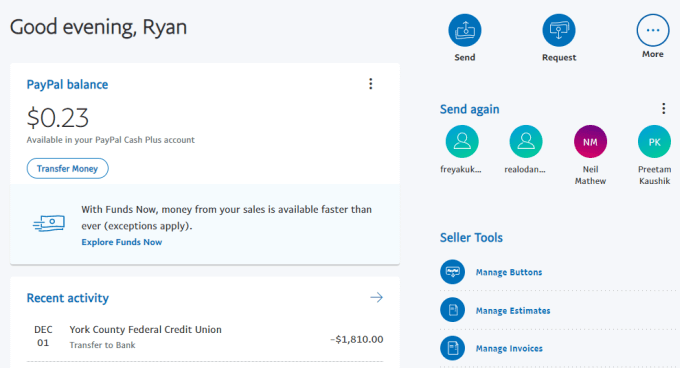

PayPal credit works like a safety buffer for your PayPal account. Unfortunately whether you transfer money from your bank account to PayPal, or someone has paid you via PayPal, it takes a few days for the money to come in.

Buying Things While Waiting For a Payment

Your account may be near zero, but since you have money coming in, there’s no reason you shouldn’t be able to use your account to buy something using your PayPal account.

With PayPal credit, even if your account is nearly zero, you can still buy things and not have to worry. Once you receive the payment into your account, you can pay off the credit you used.

Use PayPal Credit As An Alternative Credit Card

The psychology of owning a high limit credit card often leads people to overspend. Before they know it, they’ve used up $5,000 or $6,000 of a $10,000 credit card limit.

That’s not the kind of amount that most people can pay off in a month, so they’re forced to roll over most of the balance from month to month and pay significant interest charges.

Paypal credit lets you use credit for small purchases, but not so much that you can’t afford to pay it off each month. Paying the entire balance off means you’ll avoid paying the 25.99% interest rates that come along with smaller purchases under $99.

This doesn’t mean that you can’t roll over a balance and avoid interest charges, but only if you make purchases larger than $99. You’ll also need to make sure you pay off those charges before the 6 month limit.

Paying For Basic Necessities

Let’s face it, sometimes the needs of life occasionally exceed your monthly income. It doesn’t happen every month, but at times like the holidays it can happen.

Using PayPal to buy groceries or gas is possible, considering that there are currently over 30 grocery chains across the country that accept PayPal payments.

Even online grocery stores like GrumMarket accepts PayPal.

So long as you use your PayPal credit account for things like this sparingly, and make sure to pay off the balance the very next month, this is an acceptable way to survive those difficult times.

Use The Convenience Of a Mobile App

When you use the PayPal mobile app for iOS or Android, you can closely monitor how much PayPal credit you’re using.

In addition to this, you can quickly make payments so you can stay on time and never be late with a credit payment. But even if you are, remember that missing a payment or two of your PayPal credit payments won’t hurt your credit rating like missing a credit card payment would.

Reasons You Shouldn’t Use a Paypal Credit Account

The convenience of a Paypal credit account is both a blessing and a curse. For all of the reasons stated above, it gives you access to money when you need it.

However, it’s not for everyone. If any of the items below describe you, you probably shouldn’t apply for a PayPal credit account.

- You struggle to pay off balances on time.

- You tend to compulsively buy things you don’t need.

- You’re living paycheck to paycheck.

- You already have multiple, maxed out credit cards.

If you already have bad credit habits, the 25.99% interest on the balance you don’t pay could get you into trouble quickly.

Rolling over balances beyond the 6 month limit means your PayPal credit account could become just like every one of your maxed out credit cards. You’ll find yourself paying mostly interest on a balance that can become very difficult to pay off.